Across Texas, landowners frequently discover they’ve inherited or unknowingly purchased properties with severed mineral rights – meaning the rights to oil, gas, metals and other subsurface resources belong to a different entity. This split estate situation clouds decisions about whether selling mineral rights proves beneficial if approached.

Most landowners scarcely ponder mineral components to their lands. Yet leasing or selling mineral rights potentially generates major income amid high energy prices. Here’s guidance navigating the logistics of Texas mineral ownership, valuation and sale considerations.

What are Mineral Rights Exactly?

At the most basic level, mineral rights include legal ownership permissions entitling holders to extract or produce valuable subsurface resources like oil, natural gas, metals, and coal deposits, saltwater, uranium, sand, gravel and even range grass located under the land. These extraction allowances get termed mineral rights.

In Texas, mineral rights usually comprise the dominant estate taking precedence over surface level usage rights per legal doctrines. Thus whoever holds minerals beneath essentially can access and harvest embedded resources as desired without surface owner interference even if ownerships differ – albeit with minor accommodation responsibilities.

Severity of Mineral vs. Surface Rights

Unbeknownst to many Texas property buyers unaware of scrutiny required before closing deals, the rights to land surface usage and subterranean minerals sit “severed” extremely often—meaning different owners. Severances result from past sales of just mineral components or surface level donations to towns/counties.

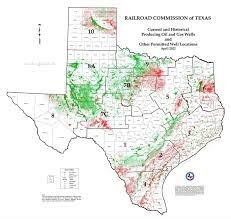

This reality emerges most prominent across Texas’s oil/gas prolific Permian Basin, Barnett Shale region and other resource hotbeds. But even lands nowhere near production zones frequently see severed rights.

Checking ownership connections between surface usage and underground resources remains imperative for both groups before assuming no severance exists. Doing so requires researching recorded deeds.

Does the Surface Owner or Previous Sellers Hold Minerals?

In Texas, mineral rights ownership defaults to surface landholders UNLESS legal documentation shows past severances transpired. This differs from other states deeming government entities as holding default mineral rights.

Thus checking county clerk deeds confirms if the chain of title transfers for your tract included verbiage about minerals getting explicitly excluded/reserved by past sellers. Phrases like “seller retains all mineral interests” or “mineral rights reserved hereby” signal a partial deed separation.

If no severing language exists within property deeds, surface owners likely maintain mineral rights unless prior unrecorded severances happened informally. This means buyers aren’t totally in the clear assuming mineral inclusion without due diligence vetting deeds alongside sellers or heirs dating back decades.

Doing further checks with county appraisal/tax assessor offices can also help verify connections between surface land parcels and mineral owners getting tax bills for underground assets. Counties derive major revenues from mineral production through appraised valuations, so records stay current.

Finding Existing Mineral Ownership Records

If deeds and appraisal documents confirm your Texas property’s mineral rights stand partially or fully severed into different ownership, various state databases help uncover who currently holds the subsurface estate along with their contracting specifics.

The Railroad Commission of Texas as the main oil/gas industry oversight body provides a Mineral Rights Ownership & Leasing Info database allowing address searches showing recorded rights-holders for lands statewide plus documents like leases. It compiles data from hundreds of counties.

Complementing this, the Texas General Land Office shoulders managing state public lands and mineral reservations. Its online resource center lets the public seek info on private mineral owners, royalty details, well permitting/production and seismic data revealing oil/gas potential on lands through various search tools.

Contacting both agencies costs nothing and produces copies of whatever mineral leases or contractual agreements encumber one’s subsurface rights presently by other parties, if any exist. Know these details aids decisions about re-selling rights.

What Do Severed Mineral Rights Usually Entail?

If severed rights confirmation reveals your land’s mineral estate rests in others’ hands through past conveyances, critical questions arise regarding how much authority they wield exploiting resources beneath your property and if any associated obligations exist.

Contract specifics alter case-by-case. But commonly, severed mineral owners/lessees gain extensive latitudes stipulated under Texas law accessing subsurface resources without excessive surface damage. This includes conducting seismic surveys, exploratory drilling, installing pipelines/well heads and harnessing minerals extracted with minimal disruption obligations to surface owners.

Surface owners maintaining no mineral rights customarily hold little power controlling exploitation methods or frequencies that severed owners/lessees pursue—albeit the latter party shoulders responsibilities paying for most damage directly induced. For example, compensating surface owners if new roads cut through property accessing wells.

Many mineral rights contracts also bind 5-10%+ royalty payment obligations to surface landholders allowing them still earn proceeds from buried assets. This attempts balancing interests. But surface owners largely must accept severed mineral extraction with modest protections unless buying both rights unified upfront.

Key Considerations on Selling Mineral Rights

The autonomy that severed mineral rights holders retain pursuing subsurface production means surface property owners have limited involvement in decisions to sell rights or lease them to oil/gas companies who then pay royalties.

Still, situations arise where surface owners get contacted by past heirs or new speculators offering to purchase all mineral interests associated with lands. This leads questions about whether sale makes prudent financial sense. Several key factors to weigh:

- Future Production Forecasts in the Region – Understanding oil/gas yield potentials and drilling projections for one’s localized area the next 10-30 years aids estimating if rights will grow more valuable. Industry geologist assessments provide the best insights forecasting production curves. High yielding zones signal holding rights until drilling matures favors maximizing royalties.

- Existing Rights Encumbrances – If mineral rights already show leased to major oil/gas producers paying sizable royalties with 20-30+ years left on agreements, selling rights to new speculators proves illogical forfeiting reliable long term royalties. But unleased rights warrant selling if top regional drillers disinterest.

- Upfront Payment Amounts Relative to Projected Royalties – Speckled interests from past co-owners or heirs may only offer below market prices expecting you’ll accept lesser offers lacking understanding of broader values. Weigh upfront payment amount offers against 5-10 year cumulative royalty generation estimates that specialty land consultants provide.

- Oil & Gas Regional Cycles – Texas mineral values fluctuate substantially when oil/gas markets rise and fall. Current high commodity pricing allows demanding premium sales prices. But selling during downturns when drillers focus less on new production means leaving money on the table long run.

If current royalty streams already flow reliably under lengthy producer contracts with activity indicators favoring sustained regional drilling,Surface owners should resist selling mineral rights to unfamiliar speculators entirely and avoid unnecessary ownership complications for modest quick payoffs jeopardizing bigger future royalties.

But owners finding no active drilling/leasing yet on holdings amid frenzied surrounding activity may prudently sell mineral rights while values run hot – and deploy earnings into other ventures rather than speculate on uncertain drilling fortunes.

Key Steps for Surface Owners to Sell Minerals

When situations align favoring a strategic mineral rights sales for surface property owners with no prior leasing – whether acquiring severed rights through an inheritance with heir disinterest keeping them or having an original unified estate – several procedural steps enable executing transactions.

- Locate a Reputable Mineral Rights Buyer – Numerous niche companies actively seek buying Texas mineral rights for portfolio holding purposes or reselling to producers. Their geology and production expertise aids evaluating fair offer pricing as middlemen.

- Get Multiple Valuation Opinions to Set Ask Price – To estimate competitive market valuations, partner with mineral valuation specialists like Curtis Minerals Advisory or Mineral Auction who aggregate regional sales data. Local landsmen may provide free valuations hoping you’ll select them leasing rights after purchase.

- Vet the Full Contract Terms Carefully – Scrutinize all fine print in purchase contracts before signing over rights. Define any royalty payment terms, surface usage allowances, liability questions and reversion clauses favorably protecting current/future land interests wherever ambiguous. Consider adding an attorney review.

- Handle Deed Filing Logistics – The buyer usually prepares new delivery deeds conveying mineral rights. But you’ll sign paperwork and must handle proper recording with the county clerk to finalize transfers legally with proof.

While individuals can attempt selling mineral rights independently to oil/gas companies directly through brokers, novice sellers often underestimate rights values or agree to disadvantageous terms lacking experience. Relying on a mineral auction house or landsmen generally secures superior sales outcomes for non-institutional owners.

(Disclaimer: The mineral rights information provided here is general guidance only. Consult qualified local real estate attorneys and professional appraisers before deciding to buy, sell, lease or transfer any mineral interests to ensure full protection of your legal interests, proper valuation and maximized financial outcomes.)